As an Uber driver in the UK, it’s key to know how to file taxes to avoid fines. The tax-free trading allowance for self-employed, like Uber drivers, is £1,000 a year. It’s vital to report your income and claim expenses correctly.

Do you know all the tax deductions you can get as an Uber driver? Do you understand the tax filing process? We aim to guide Uber drivers through their tax obligations.

As an Uber driver, you’re self-employed and must register with HMRC. This is a key step in filing your taxes.

We aim to support ride-sharing drivers by educating them on taxes. Our guide will help you understand how to file taxes as an Uber driver. You’ll learn about registering with HMRC, claiming expenses, and filing tax returns.

Key Takeaways

- Understanding your tax obligations as an Uber driver is key to avoid penalties or fines.

- Uber drivers are self-employed and must register with HMRC to file their tax returns. This is a vital step in the tax filing process.

- The tax-free trading allowance for self-employment in the UK is up to £1,000 a year. Knowing how to file taxes can help you use this allowance.

- Uber drivers can claim various business expenses to reduce their tax bill. Our guide will help you claim these expenses correctly.

- Registering with HMRC and filing tax returns on time is essential to avoid penalties or fines. Our guide will provide the necessary information.

- By following our guide, you’ll learn about the tax filing process for Uber drivers. This includes registering with HMRC, claiming expenses, and filing tax returns.

- Understanding how to file taxes as an Uber driver can help you take advantage of all tax deductions. It ensures you’re compliant with HMRC regulations.

Understanding Your Tax Responsibilities

As an Uber driver, knowing your tax duties is key. It helps you avoid fines and makes sure you claim all eligible expenses. Our Uber driver tax guide is here to help you understand your tax needs.

What Are Your Tax Obligations?

You must register for self-assessment and file a tax return yearly. This is to report your Uber income and claim business expenses. You’ll need to include all your income and claim for driving business costs.

How Income Tax Works for Uber Drivers

Uber drivers pay 20% income tax on earnings over £12,500. This rate goes up to 40% for earnings over £50,000. You also pay Class 2 and Class 4 national insurance. Our guide explains how to work out your tax and national insurance, and how to claim expenses to lower your tax.

For more details on Uber driver taxes, check out the Uber driver sign-up page. There, you’ll find our detailed Uber driver tax guide.

Registering as Self-Employed

If you drive for Uber in the UK, you must register as self-employed with HMRC. This is a simple process that you can do online. You’ll need to give personal details like your name, address, and National Insurance number.

After registering, you’ll get a unique taxpayer reference number. This is for filing your tax return. It’s important to register quickly to avoid fines. You must register by October 5th in your second year as an Uber driver.

How to Register with HMRC

To register with HMRC, just follow these steps:

- Create an online account on the HMRC website

- Provide personal details, such as your name, address, and National Insurance number

- Obtain a unique taxpayer reference number

Deadlines for Registration

Knowing the registration deadlines is key to avoid fines. You must register by October 5th in your second year. Also, you have until January 31st to submit your tax return accurately.

By registering as self-employed, you meet HMRC’s tax requirements for Uber drivers. This ensures you follow tax laws and avoid penalties.

| Deadline | Description |

|---|---|

| October 5th | Deadline for registering for self-assessment in your second tax year as an Uber driver |

| January 31st | Deadline for submitting an accurate self-assessment tax return |

Keeping Accurate Records

As an Uber driver, it’s key to keep accurate records of your income and expenses. This ensures you claim all eligible expenses and file your taxes right. You should track your mileage, fuel costs, and other driving business expenses.

There are many tools and software to help with record keeping. For example, Excel templates from TaxScouts or accounting software like Quickbooks, Xero, or Sage. You can also upload your Uber income weekly or monthly, as you like.

Essential Documents to Maintain

Here are some important documents to keep:

- Monthly statements from Uber detailing your total monthly cost, breakdown of cost, payment method, and total trips

- Detailed account activity reports, which can be accessed by logging in to business.uber.com

- Annual pension contribution summaries, which can be uploaded in any format

- Bank statements that clearly separate self-employment income and expenses from personal transactions

Tips for Effective Record Keeping

To keep records well, organize and update them regularly. Use cloud storage for easy access to your documents. Also, accounting software can help manage your taxes and upload income and expense summaries.

Accurate records help you follow tax rules and claim all eligible expenses. This can lower your tax and ensure you report correctly. For more on Uber driver taxes, check out an Uber driver tax guide.

| Document | Description |

|---|---|

| Monthly statements | Detailing total monthly cost, breakdown of cost, payment method, and total trips |

| Detailed account activity reports | Accessible by logging in to business.uber.com |

| Annual pension contribution summaries | Can be uploaded in any format |

Calculating Your Earnings

As an Uber driver, it’s key to know how to calculate your earnings. You should think about your fares, tips, and any other income. It’s important to understand what expenses you can claim and how to calculate your earnings. This way, you can make the most of all the deductions you’re eligible for.

When learning how to file taxes as an Uber driver, keep track of your business expenses. Save receipts for tax deductions. You can claim deductions for driving business expenses like fuel, maintenance, and repairs. It’s wise to set aside 25-30% of your net income for self-employment and income taxes.

Here are some key expenses to consider when calculating your earnings:

- Car-related expenses

- Phone expenses (excluding personal use)

- Deductions made by Uber

- Private car hire license costs

- Passenger amenities costs

By understanding your expenses and keeping accurate records, you can make the most of all the deductions you’re eligible for. This way, you can filing taxes for Uber drivers with confidence.

| Expense Type | Description |

|---|---|

| Car-related expenses | Fuel costs, maintenance, and repairs |

| Phone expenses | Expenses related to your phone use for Uber driving |

| Deductions made by Uber | Any deductions made by Uber for fees or commissions |

Key Tax Deductions for Uber Drivers

As an Uber driver, knowing what expenses you can claim is key. The Uber driver tax guide helps with this. You can deduct fuel, maintenance, and repairs costs. These are directly linked to your driving business.

Other expenses you can claim include:

- Mileage costs, which can be calculated using the standard mileage rate or actual costs

- Phone costs, including the cost of the phone itself, carrier charges, and essential accessories

- Tolls, car washes, and other expenses related to the maintenance of your vehicle

The depreciation of your vehicle is also a tax deduction. But, it’s only for cars used for business more than 50% of the time. By knowing what expenses you can claim, you can reduce your taxable income. This ensures you meet HMRC’s requirements for Uber drivers.

For more details on the Uber driver tax guide and HMRC tax requirements for Uber drivers, visit the official Uber website. Or, consult with a tax professional.

How to File Your Tax Return

As an Uber driver, it’s key to know how to file taxes as an Uber driver. This ensures you meet your tax duties. The tax filing for Uber drivers process is easy with the right help. First, pick the right software for your tax return. HMRC’s self-assessment portal is a top choice. For more on Uber driver needs, visit the Uber driver requirements page.

After picking your software, follow a simple step-by-step guide to file your tax return. You’ll need to share your income and expenses details. Keeping accurate records all year is vital for filing your tax return correctly.

Important things to remember when filing your tax return as an Uber driver include:

- Keeping accurate records of your income and expenses

- Claiming any eligible deductions

- Meeting the deadline for filing your tax return

By following these steps and remembering these key points, you can file your tax return right. This helps avoid penalties or fines. Always get professional advice if you’re unsure about the tax filing process.

| Tax Filing Deadline | Penalty for Late Filing |

|---|---|

| 31st January | £100 |

| 3 months late | £300 or 5% of tax due |

Important Deadlines

As an Uber driver, knowing the tax filing deadlines is key. Missing these can lead to fines and penalties. The main deadline is 31st January for filing your tax return and paying any tax you owe.

The Uber driver tax guide also mentions other critical dates. For instance, the deadline for paying class 2 and class 4 National Insurance contributions is also 31st January. If you’re driving for Uber in the UK, you must register for self-assessment by 5 October after the tax year starts.

Key Deadlines to Remember:

- 31st January: Deadline for filing tax return and paying any tax owed

- 5 October: Deadline to register for self-assessment

- 31st January: Deadline for paying class 2 and class 4 National Insurance contributions

Not filing taxes on time can result in penalties and interest from HMRC. As an Uber driver, it’s vital to report all income and keep detailed records of expenses. This ensures accurate tax filings and provides proof if HMRC asks for it.

Understanding NI Contributions

If you drive for Uber, knowing about National Insurance (NI) is key. It helps fund things like the state pension and maternity allowance. You’ll need to pay Class 2 and Class 4 NI contributions. These are based on your earnings from driving.

To figure out your NI, keep track of your income and expenses well. Use HMRC’s self-assessment portal to pay and claim back. Remember, you must pay Class 2 NI at £2.85 a week. Class 4 NI is 9% on profits between £8,164 and £45,000, and 2% on profits over £45,000.

Class 2 and Class 4 National Insurance

Here are some important points about your NI contributions:

- Class 2 National Insurance is paid weekly at £2.85

- Class 4 National Insurance is calculated at 9% on profits between £8,164 and £45,000, and 2% on profits over £45,000

- You can claim deductions on allowable expenses, such as car-related costs and phone expenses

By understanding your HMRC tax needs and keeping good records, you can pay the right amount of NI. You’ll also get to claim back on certain expenses.

VAT Registration Considerations

As an Uber driver, knowing about VAT registration is key. VAT, or Value Added Tax, is a tax on goods and services’ value added. In the UK, most things, like taxi fares, have a 20% VAT.

When to Register for VAT

You need to register for VAT if you earn over £85,000. This includes all your driving business income, like fares and fuel costs. But, tips from passengers don’t count towards VAT.

VAT Threshold for Uber Drivers

The VAT threshold for Uber drivers is £85,000, just like for other businesses. If you earn more than this, you must charge VAT on fares. You can also get VAT back on business expenses, like fuel and car upkeep.

- Charges for taxi or private hire journeys

- Referral fees

- Fuel charges

- Rental of vehicles

- Administration fees

Understanding VAT registration is vital for your business. Use a good Uber driver tax guide and file taxes accurately. This way, you can reduce your tax and increase your earnings. For more on Uber driver pay, check this website.

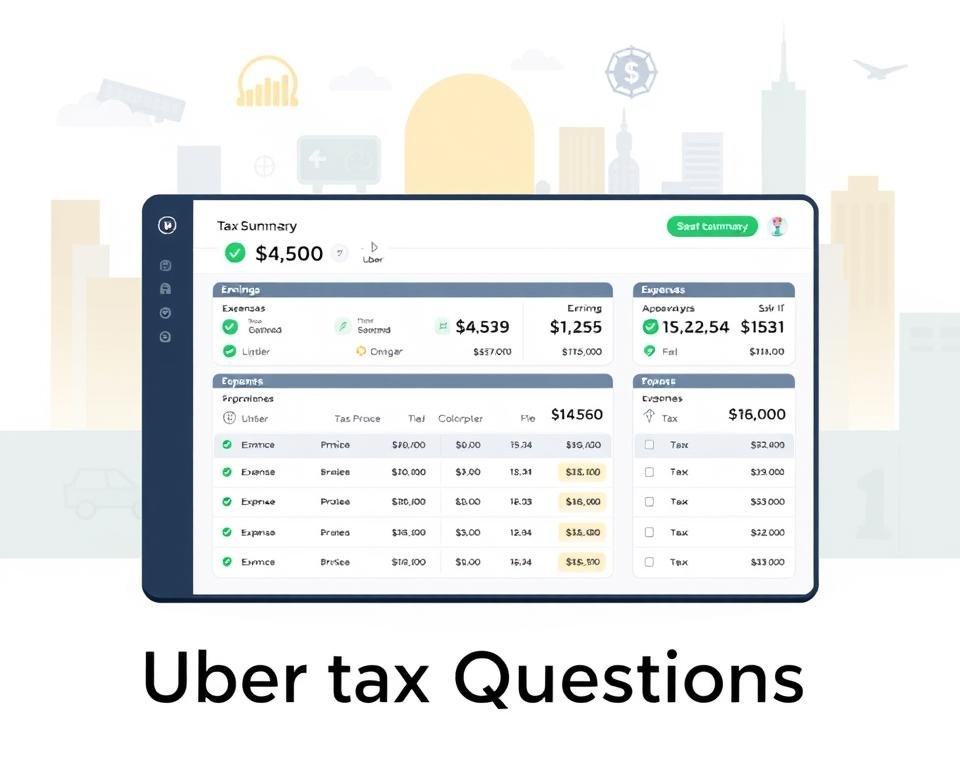

Collecting Your Uber Tax Summary

As an Uber driver, it’s key to know how to file taxes and why it’s important. Uber helps by giving drivers a tax summary. This includes earnings and expenses for the year.

This summary is very helpful. It shows your income from fares, tips, and other sources. It also lists your expenses like fuel and maintenance.

Accessing Your Annual Summary

To get your summary, just log in to the Uber app or website. You can then see and download your tax summary. It has all the info you need for taxes.

What Information Is Included?

The summary will have lots of details, such as:

- Gross earnings from Uber rides and deliveries

- Expenses, such as fuel costs and maintenance

- Tips and other income

- Information on deductions and credits you may be eligible for

Knowing how to use your Uber tax summary makes filing taxes easier. Keep good records of your income and expenses all year. This way, you can use all the deductions and credits you’re eligible for as an Uber driver.

Handling Tax Investigations

As an Uber driver, knowing how to handle tax investigations is key. HMRC might look into your tax if they think you’ve evaded taxes or made mistakes on your return. It’s important to keep all your records, like receipts, invoices, and bank statements, in order.

The HMRC website says tax investigations can start for many reasons. This includes if there are differences in your tax returns or if you haven’t reported all your income. As an Uber driver, it’s critical to follow the Uber driver tax guide and meet HMRC’s tax requirements to stay out of trouble.

What Triggers an HMRC Investigation?

HMRC might investigate Uber drivers if they think you’ve dodged taxes or made mistakes on your tax return. Some reasons include:

- Discrepancies in tax returns

- Failure to report income

- Inaccurate expense claims

How to Prepare for an Investigation

To get ready for an investigation, keeping accurate records and getting professional advice is vital. This means:

- Keeping receipts, invoices, and bank statements

- Seeking advice from a tax professional

- Ensuring compliance with HMRC tax requirements for Uber drivers

By sticking to the Uber driver tax guide and making sure you meet HMRC’s tax rules, you can lower the chance of a tax investigation. This way, if an investigation happens, it will be smoother.

Navigating Seasonal Changes

As an Uber driver, your earnings can change with the seasons. This affects your taxes. It’s key to know how to file taxes as an Uber driver to meet your tax duties. Keeping accurate records of your income and expenses all year is vital.

When filing taxes as an Uber driver, seasonal earnings impact your taxes. For instance, more earnings in the summer might mean higher taxes. Here are some tips for handling seasonal changes:

- Track your earnings and expenses monthly

- Adjust your tax payments based on your earnings

- Think about getting professional tax advice to ensure you’re meeting your tax duties

By following these tips and understanding how to file taxes as an Uber driver, you can meet your tax duties and avoid penalties. Stay organised and keep accurate records to make tax filing easy.

| Season | Earnings | Tax Obligations |

|---|---|---|

| Summer | Higher | Higher tax payments |

| Winter | Lower | Lower tax payments |

Seeking Professional Tax Advice

Being an Uber driver means dealing with complex taxes. Getting professional tax advice is key to meet your tax duties and use all deductions you can. A tax expert can explain filing taxes for Uber drivers and guide you on keeping records and filing your taxes correctly.

When looking for an Uber driver tax guide, find one that knows about self-employed taxes. Uber drivers are seen as self-employed for tax reasons. A skilled advisor will explain your tax duties, like National Insurance and VAT, if needed.

Here are some perks of getting professional tax advice:

- Accurate tax returns and less chance of mistakes

- Using all deductions to lower your tax bill

- Help on tax matters, like keeping records and meeting deadlines

Investing in tax advice ensures you follow all tax rules and use your earnings wisely. A smart tax strategy saves time, money, and stress later on.

Conclusion

Filing taxes as an Uber driver in the UK needs careful attention and a good grasp of tax rules. By following the steps in this guide, you can meet your tax duties and get the most deductions. Always keep accurate records and get tax advice when needed. Also, keep up with tax law changes.

Key Takeaways for Uber Drivers

As an Uber driver in the UK, remember to register as self-employed and keep detailed records. Claim all deductions you’re eligible for and file your tax returns on time. Knowing about national insurance contributions and VAT registration is also important for managing your taxes well.

Final Thoughts on Filing Taxes

Handling taxes as an Uber driver might seem hard, but with the right help, you can stay compliant and boost your earnings. Think about becoming an Uber driver for a flexible, rewarding income while handling your taxes.

FAQ

What are my tax obligations as an Uber driver in the UK?

In the UK, Uber drivers are seen as self-employed. This means you must register for self-assessment and file a tax return each year. You’ll report your Uber income and any other earnings. You can also claim expenses related to your driving business.

How do I register with HMRC as an Uber driver?

Registering with HMRC is easy and can be done online. You’ll need to create an account and provide personal details like your name and address. After registering, you’ll get a unique taxpayer reference number for filing your tax return.

What records do I need to keep as an Uber driver?

Keeping accurate records of your income and expenses is key. This includes mileage, fuel costs, and other driving business expenses. Also, keep records of your Uber earnings and any tips you receive.

How do I calculate my earnings and expenses as an Uber driver?

You need to calculate your Uber earnings, including fares and tips. You can also claim deductions for driving business expenses like fuel and maintenance. Knowing what expenses you can claim is important for reducing your taxable income.

What tax deductions can I claim as an Uber driver?

Uber drivers can claim various expenses, such as fuel, maintenance, and repairs. You can also claim depreciation on your vehicle. Understanding these deductions helps reduce your taxable income.

How do I file my tax return as an Uber driver?

Filing your tax return is easy with HMRC’s online portal. You’ll need to report your income and expenses. Choosing the right software and following the filing process is key to avoid penalties.

What are the key deadlines I need to be aware of as an Uber driver?

Uber drivers must meet tax return and payment deadlines. The tax return deadline is usually 31st January. Paying any tax owed by this date is essential to avoid penalties.

Do I need to pay National Insurance contributions as an Uber driver?

Yes, Uber drivers must pay class 2 and class 4 National Insurance contributions. These fund benefits like the state pension. Use HMRC’s portal to make payments based on your driving business profits.

Do I need to register for VAT as an Uber driver?

Uber drivers may need to register for VAT if their turnover is over £85,000. You’ll charge VAT on fares and pay it to HMRC. You can also claim back VAT on driving business expenses.

How can I access my Uber tax summary?

Your Uber tax summary is available through the Uber app or website. It shows your earnings and expenses for the tax year. This includes fares, tips, and expenses like fuel and maintenance.

What triggers a tax investigation for Uber drivers?

HMRC may investigate Uber drivers if they suspect tax evasion or errors in tax returns. Keeping accurate records and seeking professional advice is important for any investigation.

How do I manage seasonal changes in my Uber earnings?

Seasonal changes in earnings, like during holidays, can affect your tax. It’s important to understand these changes and adjust your records to meet tax obligations.

When should I seek professional tax advice as an Uber driver?

Seeking professional tax advice is vital for Uber drivers. A tax professional can help with complex tax rules and ensure you’re meeting your obligations. They can also guide you on keeping accurate records and filing your tax return correctly.

8 thoughts on “How to File Taxes as an Uber Driver in the UK”